4

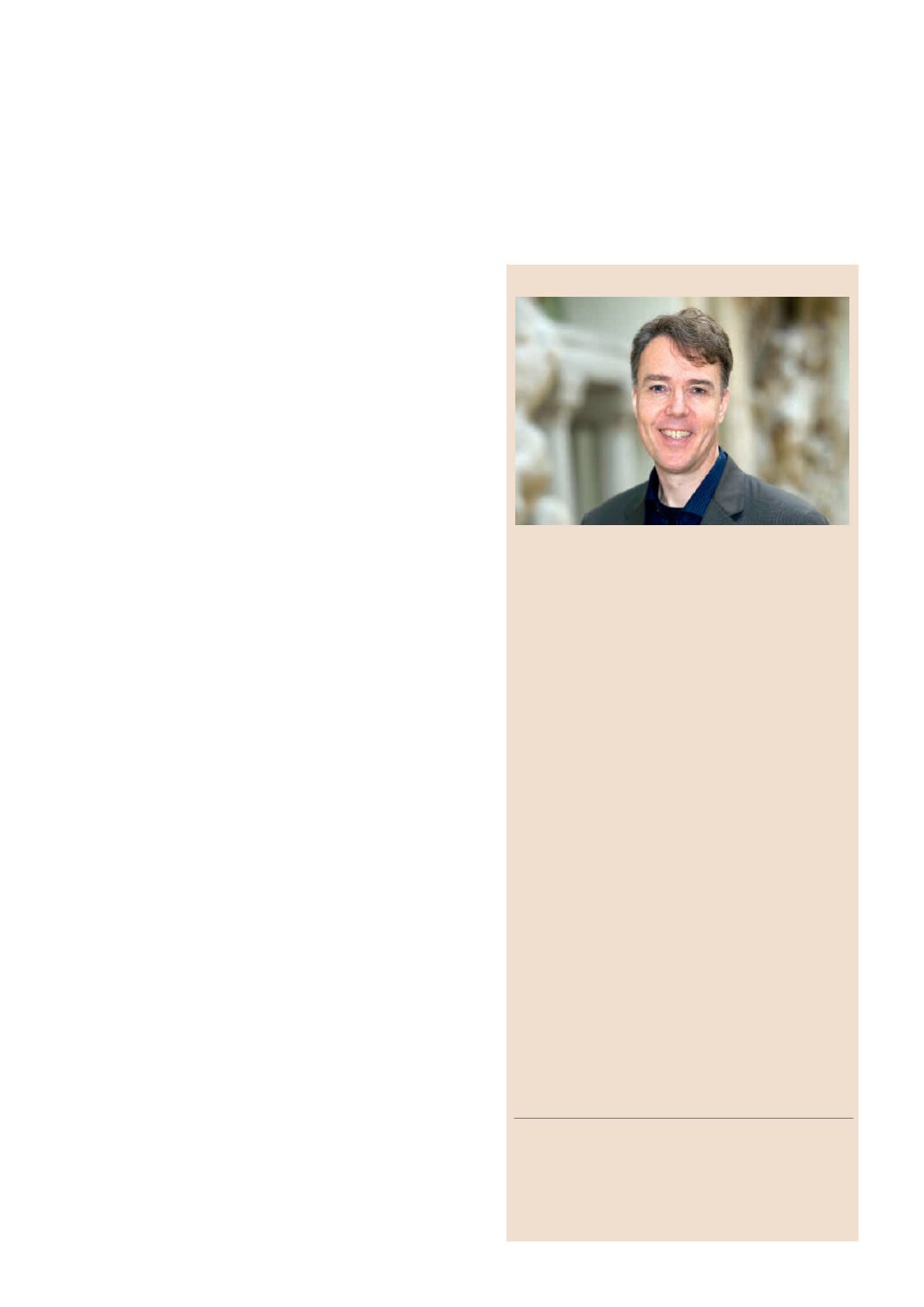

Prof. Hans-Joachim Voth

Hans-Joachim Voth has been a Professor at the

University of Zurich and an Affiliated Professor at

the UBS Center since 2014. On November 1, 2015,

he was appointed to the Professorship in Macro-

economics and Financial Markets, endowed by the

UBS Center.

Previously, Voth was a Professor at Pompeu Fabra

University, Barcelona, and was a Visiting Professor

at Princeton University, New York University,

Stanford University, and the Massachusetts Insti-

tute of Technology.

His research focuses on sovereign debt in historical

perspective, asset market volatility, the origins and

persistence of culture over the long run, political

risks, and economic performance. His academic

articles are published regularly in the top academic

journals, and his books have been published by

Oxford University Press and Princeton University

Press. Prof. Voth is also a managing editor of

The

Economic Journal

and an associate editor at

The

Quarterly Journal of Economics

.

Voth’s research as well as his opinion pieces fea-

ture regularly in the media, including

The Econo-

mist

,

Financial Times

,

The New York Times

,

The

Wall Street Journal

,

NZZ

, or

Finanz und

Wirtschaft

.

Prof. Voth’s inaugural lecture on "Fear, Folly, and

Financial Crises – Some Policy Lessons from

History" will take place at the University of Zurich

on March 7, 2016, 5 pm.

gers, but also keeps an eye on potential benefits. He

lists three such potential benefits: First, temporary

increases in sovereign debt are often less painful

than brutal reductions in government spending or

excessive tax increases, and these increases may

guarantee more continuity for enterprises. Second,

government securities can play an important role

in the willingness to accept risk on the part of

enterprises and investors, as holding secure bonds

allow them to take on higher risk in other positions.

Third, the example above has shown that, in the

presence of underdeveloped or badly functioning

financial markets, it may be preferable for people to

invest in government bonds if the available alterna-

tive asset classes have (more) detrimental effects on

the economy.

References

Gennaioli Nicola, Voth Hans-Joachim, "State Ca-

pacity and Military Conflict," Review of Economic

Studies (2015) 83, 1–47.

Ventura Jaume, Voth Hans-Joachim, "Debt into

Growth: How sovereign debt accelerated the first

industrial revolution," University of Zurich, Depart-

ment of Economics, Working Paper Series, Work-

ing Paper No. 194, ISSN 1664–7041 (print), ISSN

1664–705X (online).