10

of zero – not only as a legitimate mean for central

banks, but actually as a welcomed new addition to

their monetary policy toolkit. What is more, this

change will, in his view, prove a landmark develop-

ment:

Negative interest rates as a tool for fighting reces-

sions and deflation would be undermined if people

started hoarding large amounts of cash in order to

avoid the charging of negative interest. Rogoff thus

advocates a gradual phase-out of cash, starting with

banknotes with large denominations. Apart from

rendering negative interest rates an effective mone-

tary policy tool, such a move would have further

positive side effects, as it would make tax evasion as

well as the funding of terrorists or organized crime

much more difficult.

Hard to believe, but on top of this already very broad

subject matter, Rogoff also managed to squeeze in

substantive assessments on several other top themes

such as austerity policies (worked in Britain), secular

stagnation (completely exaggerated), and innovation

(will continue or even speed up, don’t you worry).

And while these additional topics may seem rather

diverse, their analyses shared at least one common

insight: Larry Summers got it all wrong.

Dialogue and Events

Opinions

Public Lecture on "Dealing with Debt"

In connection with the conference on sov-

ereign debt (see page 9), the UBS Center

organized a public talk on the same topic

with Professor Ken Rogoff from Harvard Uni-

versity on June 23.

Thanks to his recent best-selling book

This Time is

Different: Eight Centuries of Financial Folly

, Rogoff

is widely regarded as one of the world’s leaders on

the topic. This may explain why the main auditori-

um of the University of Zurich was much too small

for the hundreds of people who wanted to hear

what the former IMF Chief Economist had to say

about the world’s current debt problems.

Prepare for continued weakness and debt write-downs

Rogoff started off with an overview of the breadth

and depth of the current debt problem, show-

ing that debt levels – private, sovereign, external,

and pension-related – remain near record levels.

Particularly Europe is still faced with a large debt

overhang, which, as historical evidence suggests,

generally lasts for more than two decades. We must

therefore expect years more of sluggish growth as

well as further write-downs of debt.

Unfortunately, it is the very same high debt levels

that prevent governments from counteracting the

negative consequences of this debt with fiscal policy.

Meanwhile, the historically low interest rate lev-

els impair the other main policy lever – monetary

policy – for fighting low growth. In such a context,

Rogoff considers negative interest rates – i.e. setting

the base rates below the traditional lower bound

"The elimination of the zero bound

is the next major turn in monetary

policy, akin to the ending of the

gold standard and fixed exchange

rates."

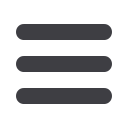

Ken Rogoff advocates for a gradual phase-out of cash

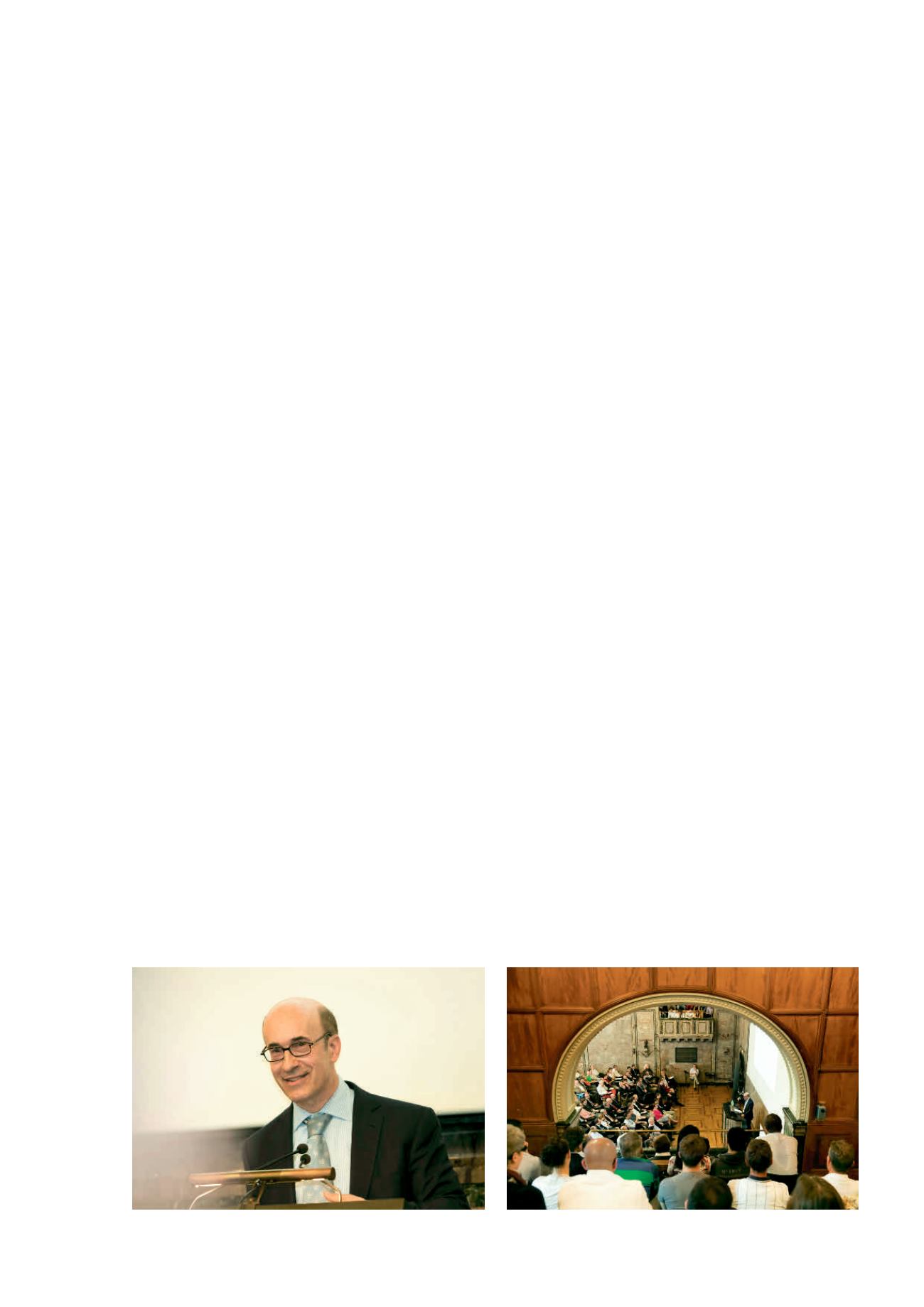

All eyes on Ken Rogoff in the main auditorium of Zurich University