12

Causes, consequences, and policy solutions

Since 1980, the world economy has experienced an increase of dominant firms. Dominant firms face limited competition in their market and exert monopoly power. Why has this happened, and why did it start in 1980? The rise of dominant firms has a direct impact on customers who pay higher prices, but it also has far-reaching implications for the macroeconomy. Widespread market power leads to wage stagnation and a decline in the labor share, it increases wage inequality, it slows down business dynamism, it reduces the number of startup firms and lowers innovation.

In this public paper Eeckhout reviews the determinants of the rise of dominant firms, discusses the causes and consequences, and proposes directions for policy solutions.

Since 1980, the world economy has experienced an increase of dominant firms. Dominant firms face limited competition in their market and exert monopoly power. Why has this happened, and why did it start in 1980? The rise of dominant firms has a direct impact on customers who pay higher prices, but it also has far-reaching implications for the macroeconomy. Widespread market power leads to wage stagnation and a decline in the labor share, it increases wage inequality, it slows down business dynamism, it reduces the number of startup firms and lowers innovation.

In this public paper Eeckhout reviews the determinants of the rise of dominant firms, discusses the causes and consequences, and proposes directions for policy solutions.

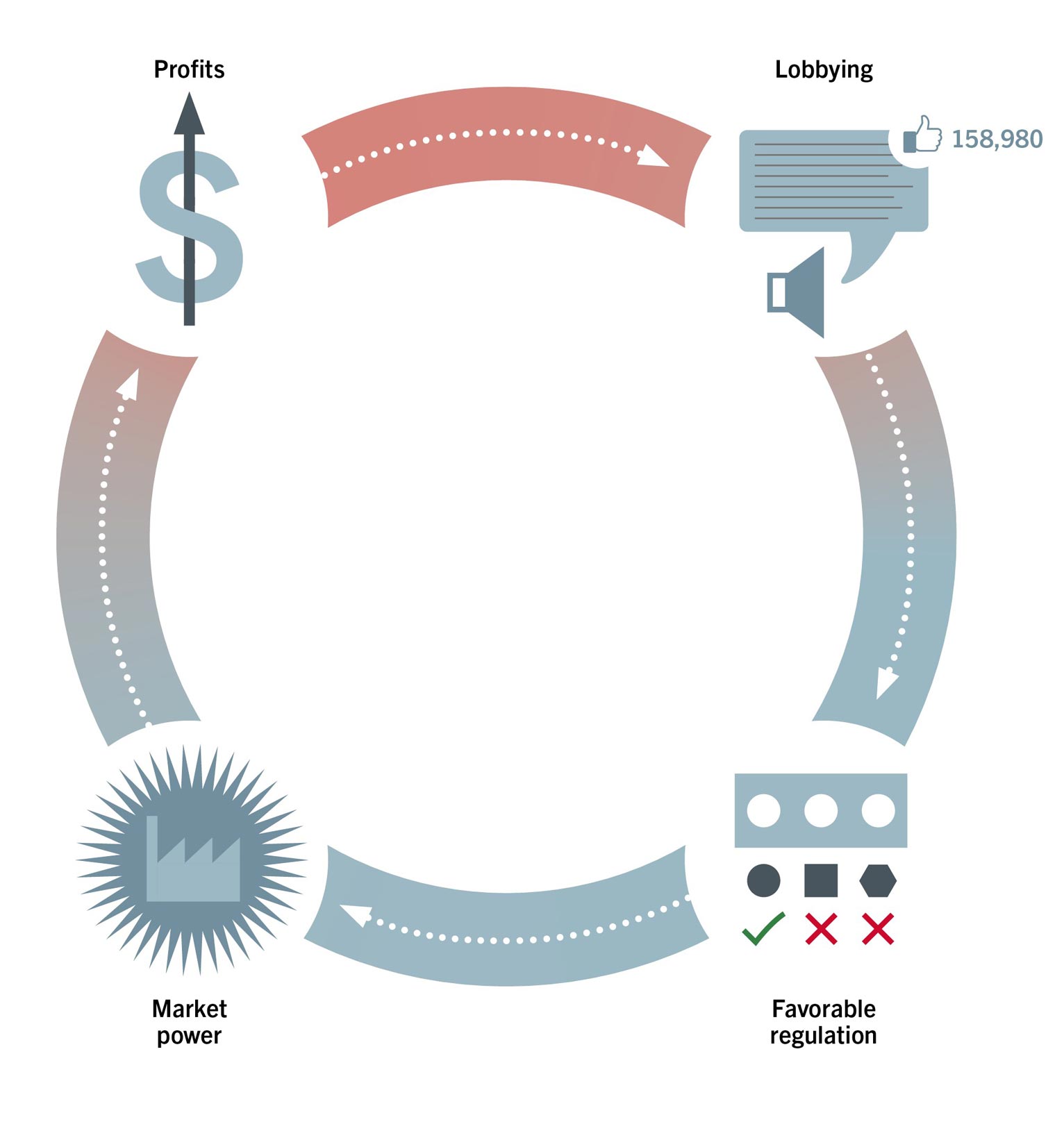

Vicious circle

Part of the reason why we don’t see a bigger impact of antitrust legislation is that firms that have market power try to influence existing and new legislation, either by blocking new laws or by using resources to win court cases under existing laws. Just like those who evade taxes are reluctant to accept more stringent tax compliance initiatives, and are willing to spend some of the resources to stop such initiatives, those who currently have market power are reluctant to get more powerful pro-competitive enforcement and are willing to dedicate resources to stop these initiatives. There is a vicious circle between market power, lobbying, and legislation. Obtaining market power generates profits. Those profits from market power can be used as resources for lobbying to influence the political decision-making process and obtain legislation that is favorable to allow for more market power.

Part of the reason why we don’t see a bigger impact of antitrust legislation is that firms that have market power try to influence existing and new legislation, either by blocking new laws or by using resources to win court cases under existing laws. Just like those who evade taxes are reluctant to accept more stringent tax compliance initiatives, and are willing to spend some of the resources to stop such initiatives, those who currently have market power are reluctant to get more powerful pro-competitive enforcement and are willing to dedicate resources to stop these initiatives. There is a vicious circle between market power, lobbying, and legislation. Obtaining market power generates profits. Those profits from market power can be used as resources for lobbying to influence the political decision-making process and obtain legislation that is favorable to allow for more market power.

Conclusion

The digital age has fundamentally transformed the global economy. This has led to technological progress and growth, and has ultimately resulted in higher standards of living. But the digital technological transformation has at the same time introduced enormous economies of scale, reaching global proportions, in which the use of data plays a key role. And with these scale economies, market power has grown since 1980. Dominant firms can exert monopoly positions and charge prices that are substantially higher than costs. As a result, they accumulate enormous profits, testament of which are the exorbitant stock market valuations of those dominant firms that are publicly traded.

Widespread market power has macroeconomic implications. In the labor market, wages have grown less than productivity, and labor force participation has fallen. As a result, the labor share has declined. In addition, due to an incomplete passthrough of shocks, business dynamism has fallen significantly. This results in lower labor reallocation and a sharp fall in the number of young, startup firms.

While the digital age has given us growth and higher standards of living, there is also a welfare cost as a result of the dominance of firms with market power compared to an economy with competitive markets. The cost to society is of the order of 8% of GDP.

There are feasible pro-competition policies that can reduce market power and the influence of dominant firms. But the successful implementation requires a lot more resources and an attempt to break the vicious circle between the profits dominant firms generate and their ability to influence pro-competitive policies and their implementation.

The digital age has fundamentally transformed the global economy. This has led to technological progress and growth, and has ultimately resulted in higher standards of living. But the digital technological transformation has at the same time introduced enormous economies of scale, reaching global proportions, in which the use of data plays a key role. And with these scale economies, market power has grown since 1980. Dominant firms can exert monopoly positions and charge prices that are substantially higher than costs. As a result, they accumulate enormous profits, testament of which are the exorbitant stock market valuations of those dominant firms that are publicly traded.

Widespread market power has macroeconomic implications. In the labor market, wages have grown less than productivity, and labor force participation has fallen. As a result, the labor share has declined. In addition, due to an incomplete passthrough of shocks, business dynamism has fallen significantly. This results in lower labor reallocation and a sharp fall in the number of young, startup firms.

Related videos

Author

Jan Eeckhout is ICREA professor of Economics at UPF Barcelona. He is the author of the book The Pofit Paradox. He studies the macroeconomic implications of market power, and the economics of work. His research has featured in the media, including The Economist, WSJ, FT, NYT and Bloomberg. He has been tenured professor at the UPenn and UCL and has been Louis Simpson Visiting Professor at Princeton. He is fellow of the Econometric Society, EEA, and Academia Europaea.

Jan Eeckhout is ICREA professor of Economics at UPF Barcelona. He is the author of the book The Pofit Paradox. He studies the macroeconomic implications of market power, and the economics of work. His research has featured in the media, including The Economist, WSJ, FT, NYT and Bloomberg. He has been tenured professor at the UPenn and UCL and has been Louis Simpson Visiting Professor at Princeton. He is fellow of the Econometric Society, EEA, and Academia Europaea.