Replay

Report

The debate around inheritance taxation consistently stirs emotions. Marius Brülhart opened his UBS Center Webcast presentation by citing a cover of The Economist that declared: “The case for taxing death.” The magazine argued that inheritance taxation is widely disliked, yet fundamentally fair, and that the case for taxing inherited assets is strong. In Switzerland, which served as Brülhart’s primary reference point, cantons historically levied inheritance taxes, but most of these were gradually abolished.

Maura Wyler-Zerboni (Text)

Hosted by UBS Foundation Professor Florian Scheuer, the conversation offered an evidence-based view of how inheritances function in modern economies and why the political debate around them is unlikely to wane any time soon. At the heart of Prof. Brülhart’s presentation stood several key questions: Why had inheritance taxes declined in Switzerland and abroad, even though many economists view them as both fair and efficient? What economic effects did inheritances actually have on work, savings, and mobility? And if societies wanted to address rising wealth concentration, which tools – tax-based or otherwise – were available?

What the data reveal

Brülhart showed that inheritances in Switzerland have risen sharply while inheritance and wealth taxes have steadily declined, a development driven by rapid growth in asset prices, at least partly due to prolonged low interest rates.

Why are inheritance taxes popular among economists while disappearing in practice? Economists typically evaluate taxes based on two main criteria: efficiency and equity. Inheritance taxation scores well on both criteria. Because inheritances are highly concentrated on a small number of wealthy families, and because heirs have rarely contributed to accumulating that wealth, inheritance taxes are generally perceived as equitable. Brülhart’s research moreover demonstrates that inheritances tend to reduce labor supply, particularly among people near retirement age. This implies that inheritance taxes can also be efficient, by incentivizing heirs to work more.

Yet, many Swiss cantons abolished their inheritance taxes in past decades, largely out of fear that wealthy residents would move away. Brülhart’s empirical research documents that taxpayer mobility was by far the dominant argument behind cantons’ decisions to cut inheritance taxes. Yet, he finds no evidence of significant tax-induced mobility triggered by changes to (already low) cantonal tax rates.

When is an inheritance tax too high?

One proposal recently discussed in Switzerland envisioned a 50 percent federal estate tax on wealth above CHF 50 million. Brülhart assessed this as problematic due to its magnitude. Evidence from the United States and from Switzerland suggests that such a steep increase would likely trigger significant outward mobility of very wealthy individuals and deter new arrivals, undermining the tax base to such an extent that net tax revenues might decrease.

In the ensuing discussion, Scheuer and Brülhart noted that while a moderate inheritance tax with broad exemptions might make economic sense, past referenda show that any bequest tax faces high political hurdles.

Beyond taxation: the role of inheritance law

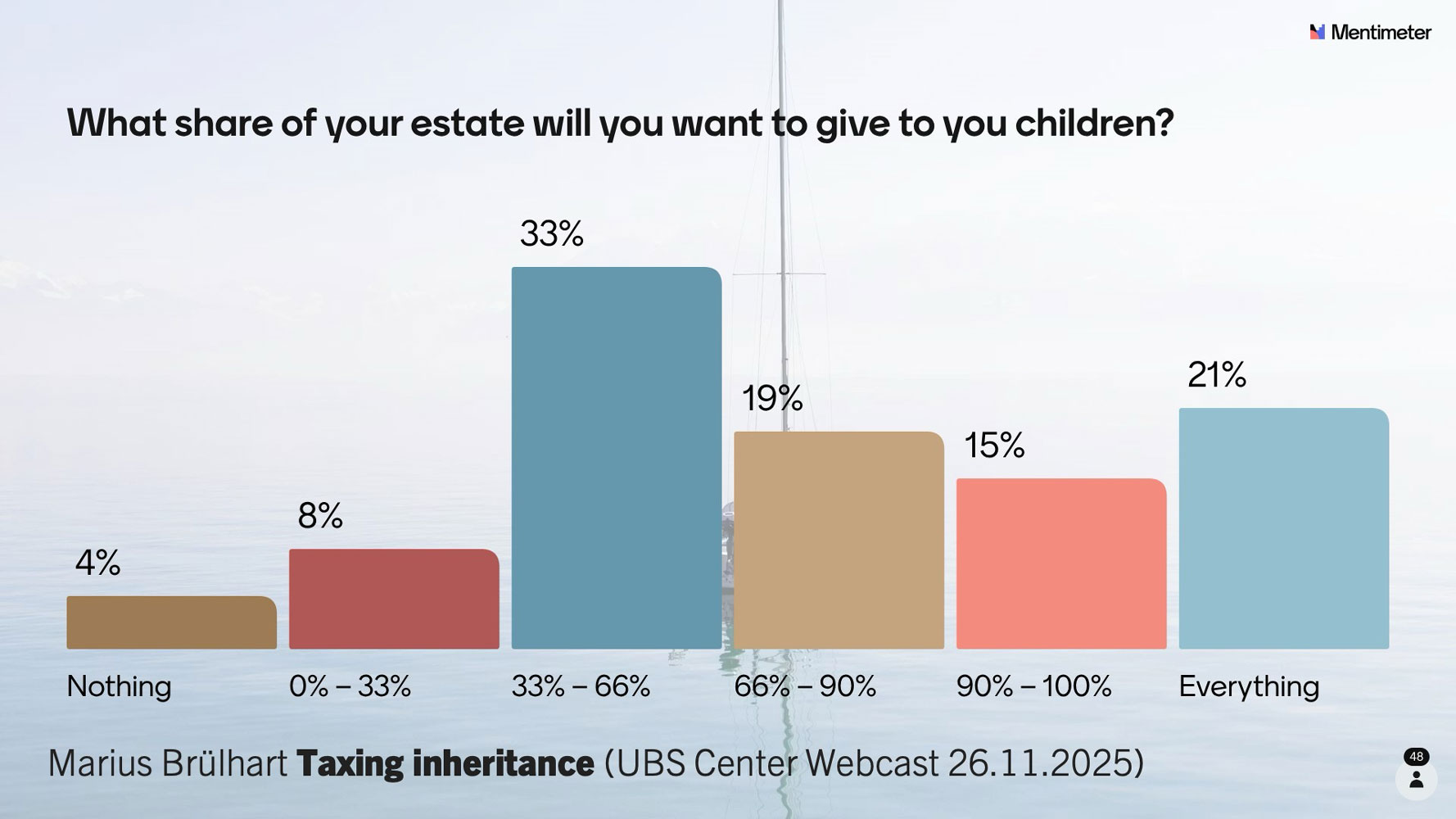

Brülhart also emphasized the importance of legal constraints to wealth diffusion at the time of intergenerational transmission. Switzerland’s 2023 inheritance law reform expanded testators’ freedom by reducing mandatory shares. Evidence from thousands of anonymized online wills shows that people are using this new flexibility to distribute wealth more broadly, to individuals outside the nuclear family and to charities. As Brülhart summarized: “Liberalizing inheritance law can support wealth diffusion without coercion.” A live poll of webcast participants (not representative) showed that almost half plan to bequeath less than 66 percent of their wealth to their direct descendants.

The debate around inheritance taxation consistently stirs emotions. Marius Brülhart opened his UBS Center Webcast presentation by citing a cover of The Economist that declared: “The case for taxing death.” The magazine argued that inheritance taxation is widely disliked, yet fundamentally fair, and that the case for taxing inherited assets is strong. In Switzerland, which served as Brülhart’s primary reference point, cantons historically levied inheritance taxes, but most of these were gradually abolished.

Maura Wyler-Zerboni (Text)

Hosted by UBS Foundation Professor Florian Scheuer, the conversation offered an evidence-based view of how inheritances function in modern economies and why the political debate around them is unlikely to wane any time soon. At the heart of Prof. Brülhart’s presentation stood several key questions: Why had inheritance taxes declined in Switzerland and abroad, even though many economists view them as both fair and efficient? What economic effects did inheritances actually have on work, savings, and mobility? And if societies wanted to address rising wealth concentration, which tools – tax-based or otherwise – were available?

Speakers

Marius Brülhart is a Full Professor at the Department of Economics, HEC Lausanne, University of Lausanne. Prior to his appointment in 2002, he had been an Assistant Professor at HEC Lausanne, a tenured lecturer at the University of Manchester (UK), and a temporary lecturer at Trinity College Dublin. He holds a PhD in Economics from Trinity College Dublin (1996) and an undergraduate degree in economics from the University of Fribourg (1991). He has advised a number of policy-making organisations, including the World Bank, the European Commission, the OECD and various Swiss government bodies (federal and cantonal).

Florian Scheuer received his PhD from MIT in 2010. He is interested in the policy implications of rising inequality, with a focus on tax policy. In particular, he has worked on incorporating important features of real-world labor markets into the design of optimal income and wealth taxes. These include economies with rent-seeking, superstar effects or an important entrepreneurial sector, frictional financial markets, as well as political constraints on tax policy and the resulting inequality. His work has been published in the American Economic Review, the Journal of Political Economy, the Quarterly Journal of Economics and the Review of Economic Studies, among other journals. In 2017, he received an ERC starting grant for his research on “Inequality - Public Policy and Political Economy.” Before joining Zurich, he was on the faculty at Stanford, held visiting positions at Harvard and UC Berkeley and was a National Fellow at the Hoover Institution. He is Co-Editor of Theoretical Economics and Member of the Board of Editors of the Review of Economic Studies. He is also a Co-Director of the working group on Macro Public Finance at the NBER. He has commented on tax policy in various US and Swiss media outlets.

Marius Brülhart is a Full Professor at the Department of Economics, HEC Lausanne, University of Lausanne. Prior to his appointment in 2002, he had been an Assistant Professor at HEC Lausanne, a tenured lecturer at the University of Manchester (UK), and a temporary lecturer at Trinity College Dublin. He holds a PhD in Economics from Trinity College Dublin (1996) and an undergraduate degree in economics from the University of Fribourg (1991). He has advised a number of policy-making organisations, including the World Bank, the European Commission, the OECD and various Swiss government bodies (federal and cantonal).

Florian Scheuer received his PhD from MIT in 2010. He is interested in the policy implications of rising inequality, with a focus on tax policy. In particular, he has worked on incorporating important features of real-world labor markets into the design of optimal income and wealth taxes. These include economies with rent-seeking, superstar effects or an important entrepreneurial sector, frictional financial markets, as well as political constraints on tax policy and the resulting inequality. His work has been published in the American Economic Review, the Journal of Political Economy, the Quarterly Journal of Economics and the Review of Economic Studies, among other journals. In 2017, he received an ERC starting grant for his research on “Inequality - Public Policy and Political Economy.” Before joining Zurich, he was on the faculty at Stanford, held visiting positions at Harvard and UC Berkeley and was a National Fellow at the Hoover Institution. He is Co-Editor of Theoretical Economics and Member of the Board of Editors of the Review of Economic Studies. He is also a Co-Director of the working group on Macro Public Finance at the NBER. He has commented on tax policy in various US and Swiss media outlets.