Enabling world-class research

Dina Pomeranz’s research addresses two of the most pressing issues in development economics: improving tax capacity in low- and middle-income countries and managing the impacts of climate change. Her work bridges academic research and policy, focusing on practical solutions that foster sustainable economic growth and help vulnerable nations adapt to climate change. Explore how her research tackles these critical global challenges.

Pressing challenges to address

- How can we bridge the research gap on low- and middle-income countries?

- How can we increase tax capacity in low- and middle-income countries?

- How to address climate change adaptation and decarbonization in low- and middle-income countries?

The research gap in development economics

Development economics is the economics of low- and middle-income countries. About 84 % of the world’s population live in low- and middle-income countries, while only around 16 % live in high-income countries. Nevertheless, the vast majority of research in economics focuses on high-income countries. This challenge is therefore a fundamental one to the entire field: how to increase the economics research that studies countries at all levels of economic development equally.

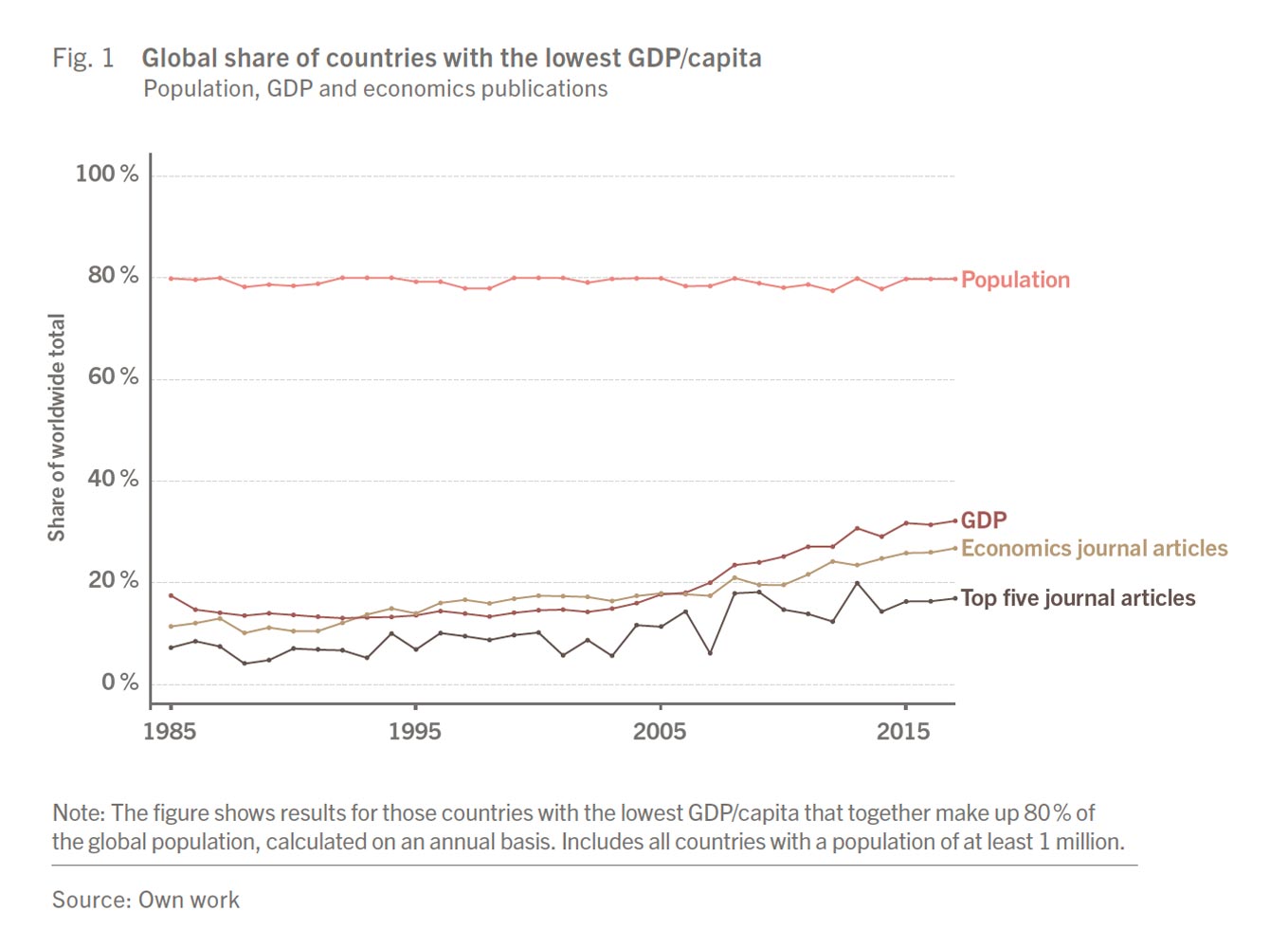

We undertook a systematic review of the geography of publications and found that the lower the GDP per capita of a country, the less economics research studies that country. Figure 1 shows that 80 % of the global population lives in countries that make up, on average, only 17 % of articles in economics journals. In the top five journals, this share is even smaller, with just 11 % on average.

When we don’t study the realities of the countries in which most human beings live, it leads to critical knowledge gaps. To reduce this knowledge gap, both representation of researchers and content of research matters. Without the local expertise from economists who stem from low- and middle-income countries, we miss a lot of information about the key challenges, policies, and interesting research questions.

For this reason, together with colleagues, we started the Graduate Applications International Network (GAIN) that supports students from African countries in the application process for graduate schools in economics and related fields at leading universities.

In addition to increasing the representation of researchers from all parts of the globe, it’s also great to see that economics research on low- and middle-income countries is increasingly no longer seen as something separate from the rest of the discipline. More and more economists realize that high-income countries are the minority in the world, not the norm. Researchers increasingly study similar phenomena in both high- and lowerincome countries, rather than focusing just on one geographic area.

Strengthening tax capacity in low- and middle-income countries

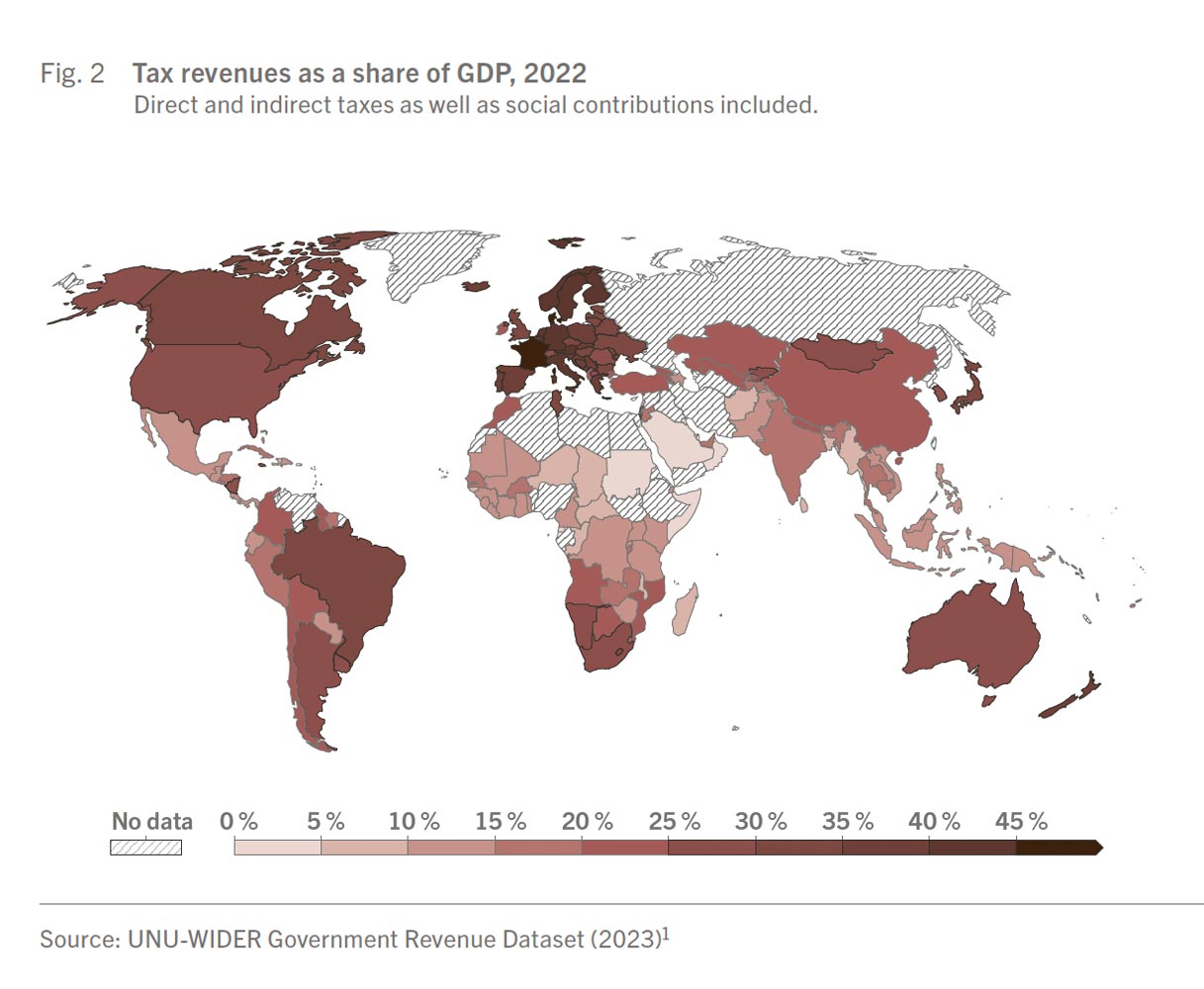

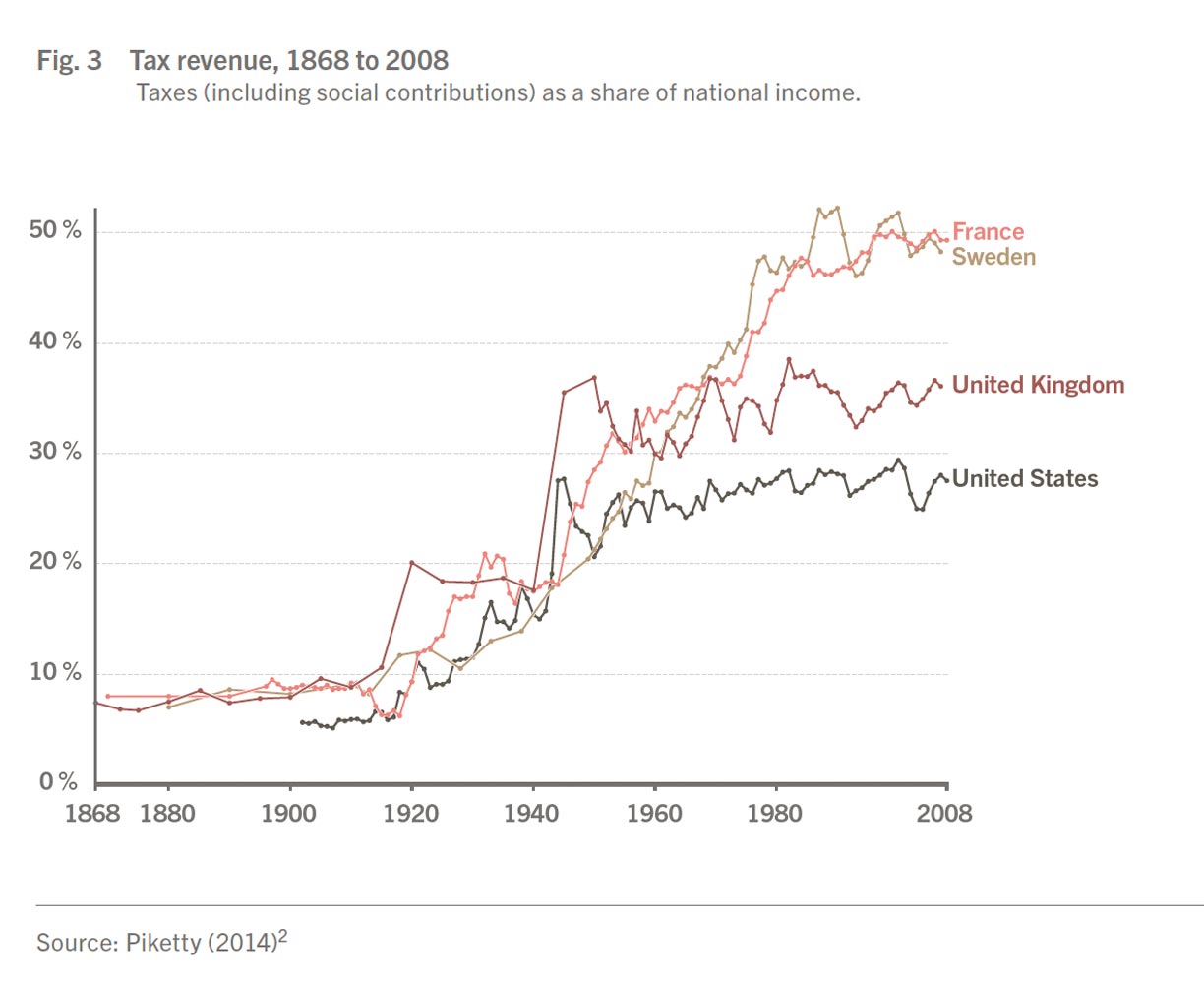

No modern state can exist in the long term without effective taxation. Lowand middle-income countries generally tend to have a much smaller tax-to-GDP ratio than high-income countries, as shown in the map on page 46. When countries have a lower GDP, and a low tax collection as a share of GDP, they end up with a very small government budget (figure 3).

The entire country of Mali (population 23 million), for example, raises a smaller amount of annual taxes than the city of Zurich. In order to fund basic infrastructure, social services, education, etc., many countries aim to strengthen their capacity to raise taxes in an effective and fair manner.

The capacity to raise taxes effectively is relatively recent also in today’s rich countries. Looking at historic data from today’s rich countries, we see that until the early twentieth century, high-income countries had a tax revenue as a share of GDP near or below 10 %. This is a similar share to that of today’s low-income countries. Contrary to what many people believe, the main issue is not cultural, but a function of formalization of the economy, and of policies such as verifiable paper trails, which make it easier for the government to observe – and tax – economic activity.

The challenge that both high-income countries a century ago and low- and middle-income countries today face is how they can navigate the objectively more difficult-to-tax contexts in which they operate. This includes the limited access to reliable information about taxpayers and presence of large informal sectors.

Tackling climate change in low- and middle-income countries

Lower-income countries contribute less to climate change and are at the same time more heavily affected by its impacts. High-income countries currently contribute almost half of all carbon emissions, despite only representing 16 % of the global population. Low-income countries, which make up 9 % of the world’s population, emit only 0.4 % of global CO2. Middle-income countries make up an increasing share of total emissions.

How low and middle incomes can adapt to the coming impacts of climate change, and how middle-income countries can decarbonize their economies, is therefore a growing challenge. This involves policies such as livelihood diversification, infrastructure improvements, and agricultural adaptation. It is a big un answered question how countries can do this in an effective way, and ideally can at the same time spur economic growth in the process.

The challenge for these countries is to adapt to the impacts of climate change and decarbonize their economies without jeopardizing their recent economic progress in lifting billions of people out of extreme poverty.

While a growing number of countries have managed to achieve “decoupling,” where their economies have kept growing while emissions have fallen, in order to limit the negative impact of climate change, this reduction in emission will need to accelerate. Every additional year of emissions makes a substantial difference in how much global temperatures will rise.

Shaping policy through economic insights

My motivation for pursuing economic research lies in its potential for highly relevant, impactful work and the exciting, broad range of topics it deals with. Equally rewarding is the collaborative nature of this work. I have had the privilege of working with people from diverse backgrounds, each bringing unique perspectives that enrich the research process and make the outcomes more robust and relevant.

Our empirical methods and the increasing availability of high-quality data are strengthening our ability to study complex societal issues. The better our data and methodologies, the more nuanced the ways in which we identify what works and why. This, in turn, creates the opportunity to base decisions less on ideological assumptions and more on empirical evidence.

In a small way, I aim to contribute to sharing research insights with policymakers and contribute to evidenceinformed policymaking. In my own research, I work closely with institutions such as tax authorities, public procurement agencies, business organizations and employee associations. This not only helps me to discover important unanswered questions and get access to interesting data, but also steers my research in a direction that is of interest to decisionmakers in practice.

Pushing the frontiers of knowledge

The UBS Center has had an incredibly positive impact on the economics department as a whole, and in development economics in particular. Its generous funding and support have allowed the department to grow into one of the world’s leading centers for development economics research. The department now has five professors whose research focuses primarily on low- and middle-income countries, and multiple additional professors with occasional work in these areas. This generates the kind of dynamic energy and peer effects that spur innovative, creative, and rigorous work.

The UBS Center has been instrumental in pushing the frontiers of knowledge not only by supporting professors but by allowing us to attract outstanding doctoral students in the field, supporting high-quality research dissemination projects, and fostering international collaboration through conferences and events. The UBS Center also plays a crucial role in introducing students in Zurich to the cutting-edge research that is being conducted at the department. This has significantly helped to raise students’ awareness of the field and inspires and attracts a new generation of young development economists.

One of the center’s greatest contributions is its unwavering focus on promoting research excellence. It provides the resources and freedom necessary for conducting innovative and impactful studies while maintaining the highest standards of independence and quality. The center’s support for conferences and workshops has further elevated Zurich’s reputation as a leading venue for dialogue and collaboration among experts in this field. Among others, the UBS Center has generously contributed to the annual Zurich Conference on Public Finance in Developing Countries, which quickly became the leading global conference with a dedicated focus on the public-finance-development nexus. This further increased the department’s stature and boosted scientific exchange and work on the topic.

Dina Pomeranz’s research addresses two of the most pressing issues in development economics: improving tax capacity in low- and middle-income countries and managing the impacts of climate change. Her work bridges academic research and policy, focusing on practical solutions that foster sustainable economic growth and help vulnerable nations adapt to climate change. Explore how her research tackles these critical global challenges.

Pressing challenges to address

- How can we bridge the research gap on low- and middle-income countries?

- How can we increase tax capacity in low- and middle-income countries?

- How to address climate change adaptation and decarbonization in low- and middle-income countries?

The research gap in development economics

Development economics is the economics of low- and middle-income countries. About 84 % of the world’s population live in low- and middle-income countries, while only around 16 % live in high-income countries. Nevertheless, the vast majority of research in economics focuses on high-income countries. This challenge is therefore a fundamental one to the entire field: how to increase the economics research that studies countries at all levels of economic development equally.

We undertook a systematic review of the geography of publications and found that the lower the GDP per capita of a country, the less economics research studies that country. Figure 1 shows that 80 % of the global population lives in countries that make up, on average, only 17 % of articles in economics journals. In the top five journals, this share is even smaller, with just 11 % on average.

Quotes

Economic challenges of our time

From rising inequality and global trade tensions to climate change and the impact of artificial intelligence on labor markets – economists today are grappling with fundamental questions that will shape our collective future. In this special edition of the Public Paper series, all affiliated professors of the UBS Center share their perspectives on these challenges. Their contributions highlight how cutting-edge research conducted at the Department of Economics at the University of Zurich can help us better understand – and potentially solve – some of the most urgent issues of our time.

It is precisely this ambition that defines the UBS Center for Economics in Society. Since its founding, the Center has served as a platform for dialogue between academia, business, and policymakers and as a catalyst for excellence in economic research. That vision goes back to Kaspar Villiger. As the founding Chairman of the Foundation Council, he played a pivotal role in establishing and shaping the UBS Center.

With this fifteenth edition of the Public Paper series, we honor Kaspar Villiger’s extraordinary contributions and legacy. By strengthening research capacity at the University of Zurich and fostering public dialogue around key societal questions, his vision continues to inspire the Center’s mission: bridging knowledge and society to build a better future.

From rising inequality and global trade tensions to climate change and the impact of artificial intelligence on labor markets – economists today are grappling with fundamental questions that will shape our collective future. In this special edition of the Public Paper series, all affiliated professors of the UBS Center share their perspectives on these challenges. Their contributions highlight how cutting-edge research conducted at the Department of Economics at the University of Zurich can help us better understand – and potentially solve – some of the most urgent issues of our time.

It is precisely this ambition that defines the UBS Center for Economics in Society. Since its founding, the Center has served as a platform for dialogue between academia, business, and policymakers and as a catalyst for excellence in economic research. That vision goes back to Kaspar Villiger. As the founding Chairman of the Foundation Council, he played a pivotal role in establishing and shaping the UBS Center.

Raising money for the state

Author

Dina Pomeranz received her PhD from Harvard in 2010. Prior to joining the University of Zurich, she was an assistant professor at Harvard Business School and a Post-Doctoral Fellow at MIT's Poverty Action Lab. Her research focuses on developing countries, in particular on public finance, taxation, public procurement and firm development. Taking state-capacity research to the field, she works closely with the governments in Chile, Ecuador and Kenya to analyze strategies to strengthen public finance capabilities, and measure the impacts on government agencies, citizens and firms. Her work has been published in academic journals including the American Economic Review, the American Economic Journal - Applied Economics, and the Journal of Economic Development. In 2017, she was awarded one of the highly competitive ERC Starting Grants for her research on tax evasion and the role of firm networks. In 2018, she received the Excellence Prize in Applied Development Research of the “Verein für Socialpolitik”, was named as one of the top 10 most influential economists in Switzerland by a consortium of Swiss newspapers and was elected to the Council of the European Economic Association for a 5-year term.

Dina Pomeranz received her PhD from Harvard in 2010. Prior to joining the University of Zurich, she was an assistant professor at Harvard Business School and a Post-Doctoral Fellow at MIT's Poverty Action Lab. Her research focuses on developing countries, in particular on public finance, taxation, public procurement and firm development. Taking state-capacity research to the field, she works closely with the governments in Chile, Ecuador and Kenya to analyze strategies to strengthen public finance capabilities, and measure the impacts on government agencies, citizens and firms. Her work has been published in academic journals including the American Economic Review, the American Economic Journal - Applied Economics, and the Journal of Economic Development. In 2017, she was awarded one of the highly competitive ERC Starting Grants for her research on tax evasion and the role of firm networks. In 2018, she received the Excellence Prize in Applied Development Research of the “Verein für Socialpolitik”, was named as one of the top 10 most influential economists in Switzerland by a consortium of Swiss newspapers and was elected to the Council of the European Economic Association for a 5-year term.