1

Video summary

In a nutshell

Over the past 30 years, labor’s share of GDP in industrialized countries has fallen. This means that a declining fraction of aggregate income is going to workers, while firm owners obtain more.

This policy brief explains this phenomenon by identifying so-called ‘superstar’ firms as drivers of the falling labor share. It spotlights rising concentration in various industries, characterized by a ‘winner take most’ feature, in which a small number of companies gain ever larger large market shares, with consequent advantages to their profitability. Such ‘superstar’ firms, which have often achieved their primacy thanks to technological prowess and innovation, only have to spend a relatively small proportion of their revenues on wages and salaries. As these companies grow, revenues and profits rise at faster rates than personnel expenses. The rising dominance of ‘superstar’ firms in the economy therefore shifts the distribution of income in favor of firm owners, while the income share of employees declines.

Over the past 30 years, labor’s share of GDP in industrialized countries has fallen. This means that a declining fraction of aggregate income is going to workers, while firm owners obtain more.

This policy brief explains this phenomenon by identifying so-called ‘superstar’ firms as drivers of the falling labor share. It spotlights rising concentration in various industries, characterized by a ‘winner take most’ feature, in which a small number of companies gain ever larger large market shares, with consequent advantages to their profitability. Such ‘superstar’ firms, which have often achieved their primacy thanks to technological prowess and innovation, only have to spend a relatively small proportion of their revenues on wages and salaries. As these companies grow, revenues and profits rise at faster rates than personnel expenses. The rising dominance of ‘superstar’ firms in the economy therefore shifts the distribution of income in favor of firm owners, while the income share of employees declines.

Opportunities for action

1

The rise of ‘superstar’ companies has serious implications for competition law, particularly if further research determines such firms indeed exploit relative market dominance to erect entry barriers and other obstacles to competition.

2

People on lower incomes should have the opportunity to benefit from the change in the economic environment by sharing in rising investment income through their pension provisions. Separately, extending employee profit participation schemes would ensure a more equitable distribution of earnings between labor and capital.

3

Increasing regulatory activity can be comparatively advantageous to large corporations as they are better able to deal with complicated regulation and can pass on costs to a very broad customer base. This must be taken into account when formulating policies.

1

The rise of ‘superstar’ companies has serious implications for competition law, particularly if further research determines such firms indeed exploit relative market dominance to erect entry barriers and other obstacles to competition.

2

People on lower incomes should have the opportunity to benefit from the change in the economic environment by sharing in rising investment income through their pension provisions. Separately, extending employee profit participation schemes would ensure a more equitable distribution of earnings between labor and capital.

Conclusions

Very large ‘superstar’ companies account for a rising share of overall economic activity. These superstars are more profitable than smaller firms, which means that a larger fraction of their income is going to the firms’ owners rather than to employees. The growing dominance of such companies has contributed to a declining share of labor in national income both in the US and in Europe.

The data demonstrate clearly a rise in sales concentration across the vast bulk of the US and international private sectors, spurred by the rising market shares of superstars. Those industries with larger increases in product market concentration have seen larger declines in the labor share, as sales and value added have been reallocated from smaller to larger companies. The industries that are becoming most concentrated are also those with the fastest growth in productivity and innovation. It appears that the technological development has changed the economic environment profoundly, with large companies being most successful in exploiting the opportunities offered by new technologies. The rising market dominance of ‘superstar’ firms generates challenges for competition policy.

The reduction of labor’s share of aggregate income and the corresponding increase in capital’s share contribute to rising income inequality in society. While the overall share of labor has declined, there have also been significant displacements within that share. The proportion attributable over the years to the lowest paid has generally declined compared with better paid counterparts.

This UBS Center Policy Brief summarizes:

‘The Fall of the Labor Share and the Rise of Superstar Firms’ by by David Autor (MIT), David Dorn (University of Zurich), Lawrence F. Katz (Harvard University) Christina Patterson (Chicago Booth) and John Van Reenen (MIT), published in Quarterly Journal of Economics 135(2): 645-709 in 2020.

Very large ‘superstar’ companies account for a rising share of overall economic activity. These superstars are more profitable than smaller firms, which means that a larger fraction of their income is going to the firms’ owners rather than to employees. The growing dominance of such companies has contributed to a declining share of labor in national income both in the US and in Europe.

The data demonstrate clearly a rise in sales concentration across the vast bulk of the US and international private sectors, spurred by the rising market shares of superstars. Those industries with larger increases in product market concentration have seen larger declines in the labor share, as sales and value added have been reallocated from smaller to larger companies. The industries that are becoming most concentrated are also those with the fastest growth in productivity and innovation. It appears that the technological development has changed the economic environment profoundly, with large companies being most successful in exploiting the opportunities offered by new technologies. The rising market dominance of ‘superstar’ firms generates challenges for competition policy.

Callouts

In detail

At its simplest, the total economic activity of a country can be attributed to two main factors of production: labor and capital. For much of the twentieth century, the relative contributions of labor income and capital to national value added were thought to be stable. This balance was considered a basic law of economics growth. John Maynard Keynes argued it was “something of a miracle” that the ratio of labor to capital income was constant.

The share of GDP attributable to labor is declining

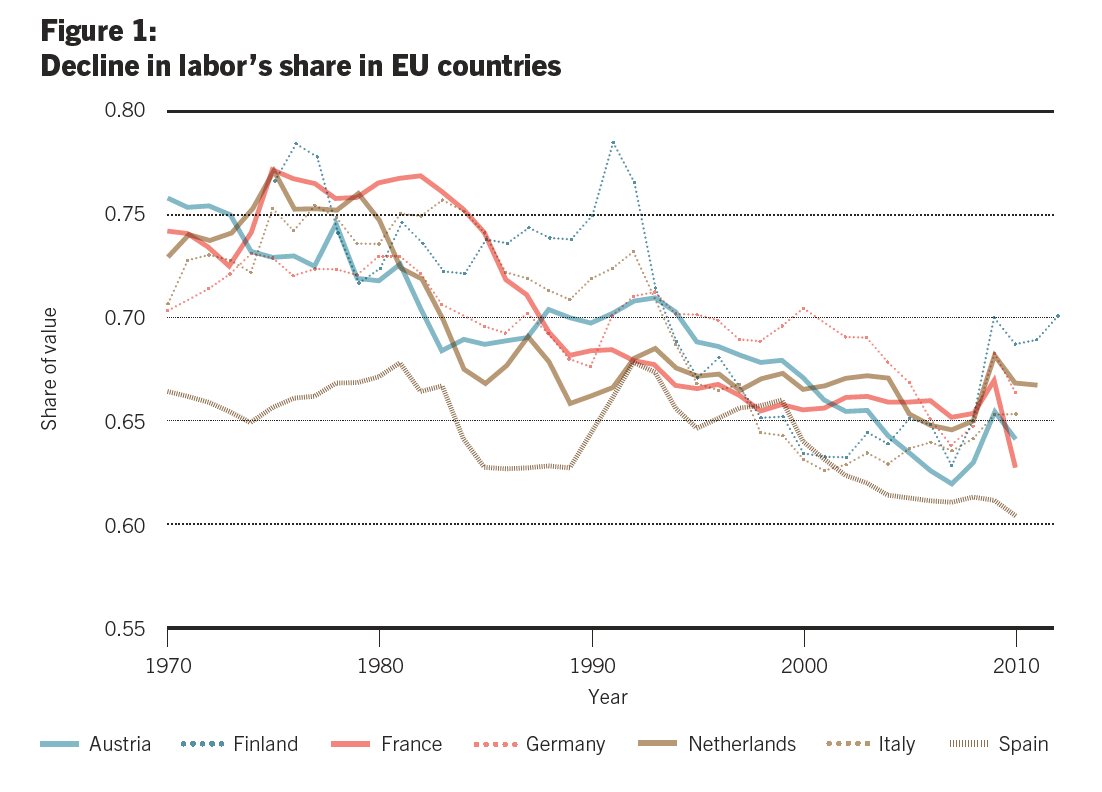

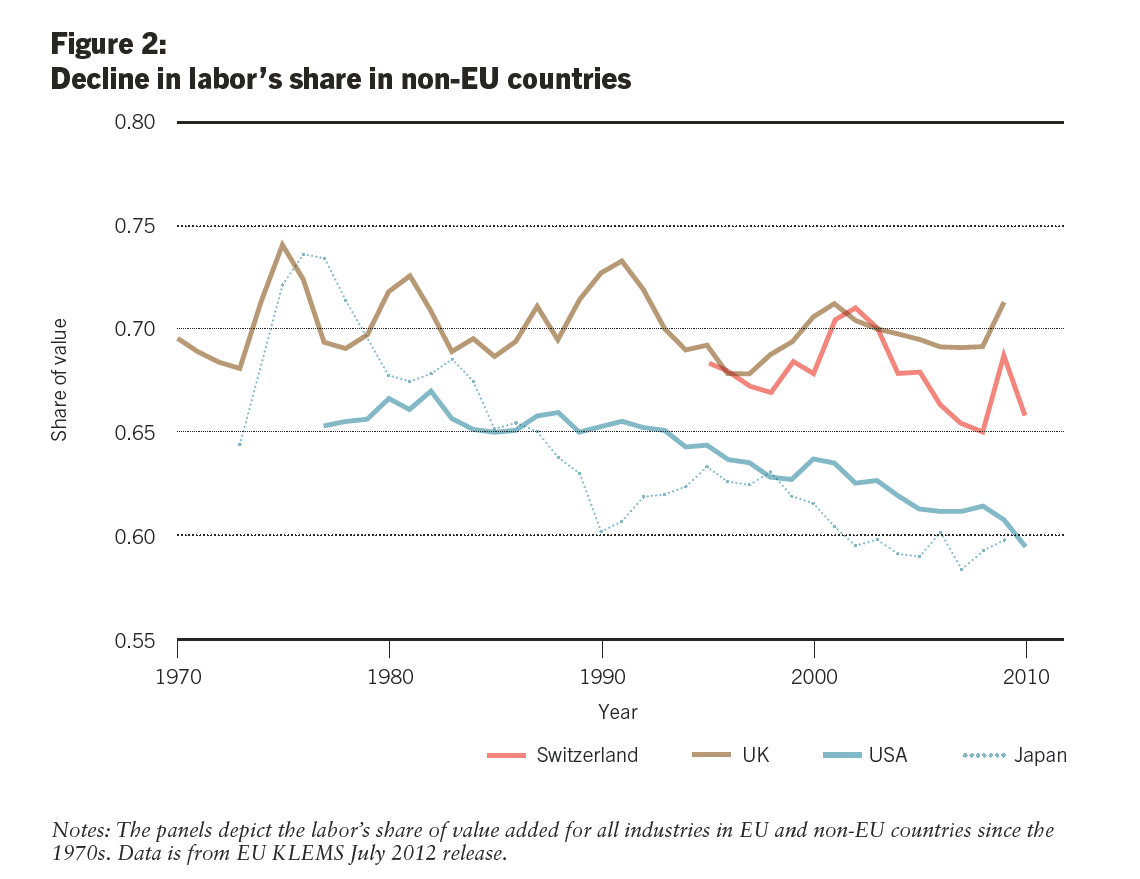

Recent decades, however, have seen a drop in labor’s share of GDP, shifting the distribution of value added between labor and capital. Workers have tended to benefit ever less from the economic growth generated by their efforts. While the income share of labor in the US, for example, was more than 66% in 1980, it had fallen below 60% by 2010. In Germany, the drop was from 73% in 1980 to just over 66% by 2010 (Figure 1).

While this shift is well documented, its causes are the subject of intense debate. For some economists, the reason lies in the falling prices of capital goods: having become cheaper relative to labor, these are being exploited more widely, especially to automate routine tasks. Other economists, by contrast, stress the importance of trade and outsourcing, notably including the rise of lower cost manufacturing in China. Still others focus on changing social norms embracing the decline of trade unions and the real value of the minimum wage.

A small number of companies gain a large share of the market

This policy brief argues the shift stems to an important extent from the rise of so-called ‘superstar’ firms. Industry consolidation and technological innovation have resulted in the emergence of a relatively small number of extremely large and agile companies, wielding significant market power. In many cases, such companies have become so ubiquitous and powerful it has become hard to imagine life without them; think Apple, Amazon, Google or Microsoft.

Such developments have led, in many industries, to a ‘winner take most’ characteristic, whereby the small number of dominant participants gain very large market shares. In online platforms, for example, Google has an outstanding market share among search engines, amounting to more than 90%. The same applies to e-commerce, where business is split between a handful of top players, led by Amazon. In the digital world especially, each marginal extra customer hardly adds to the workload or wage bill of a firm’s employees, but it generates more profit for the firm’s owners.

But increasing concentration is evident not only among companies of the ‘new economy’ and those related to the internet. There is also rising market dominance by very large firms in such sectors as retail sales, financial services, and manufacturing. The retailer Walmart was only a US regional force thirty years ago, but it has since become the world's largest company by sales. Its revenues of $524bn in the year 2020 were roughly equivalent to the annual GDP of Sweden.

A note about methodology

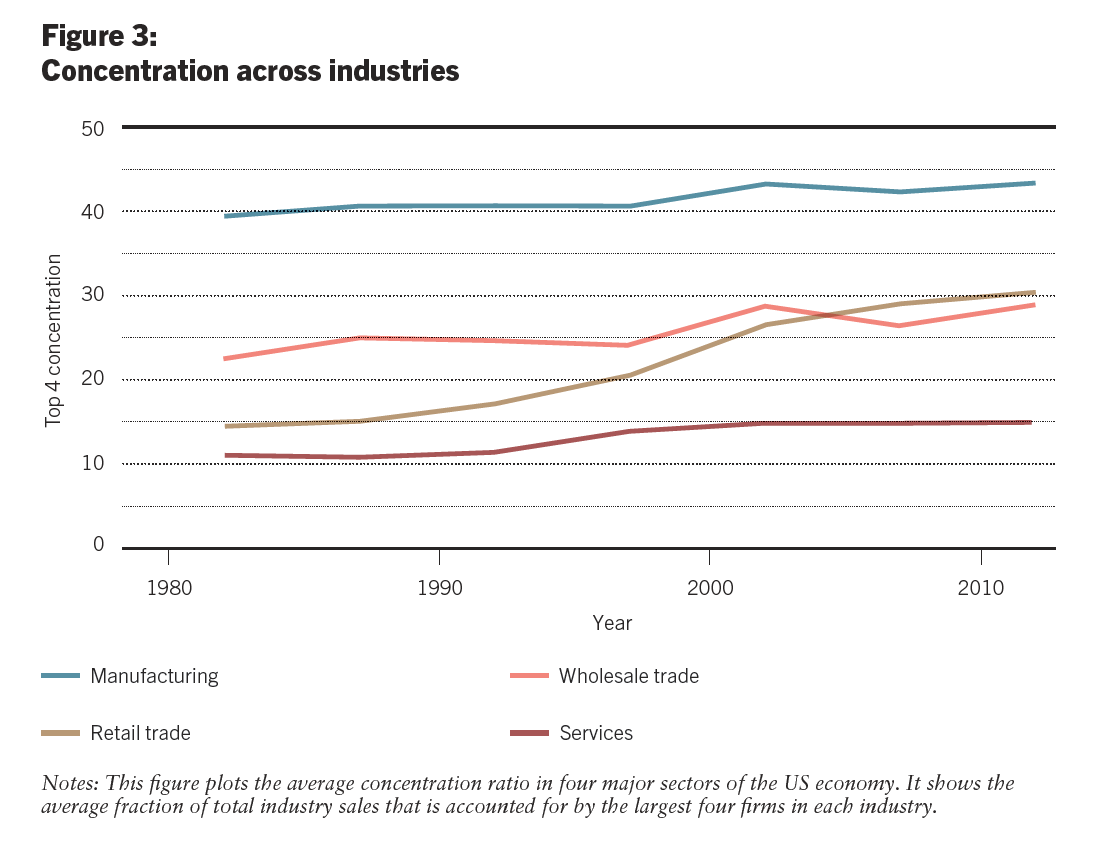

The paper’s conclusions have been derived from examining data of the Economic Census, a five-yearly survey of all firms in major sectors of the US economy. For each firm, the Census reports such variables as total annual payroll, total output and total employment. For this paper, the Economic Census for the three decades 1982-2012 was studied. The analysis includes the six sectors of manufacturing, retailing, wholesale trade, services, utilities and transportation, and finance. Together the six account for about 80% of the US workforce and economic activity. In all the sectors analyzed, the average market share of the four leading firms in a detailed industry has increased substantially since the 1980s (Figure 2).

These results are complemented by an analysis of European data, which shows similar trends. The European data includes industry-level information from the EU KLEMS database, data on company balance sheets from 14 European countries compiled by the European Central Bank, and the BVD Orbis database on company level labor shares in manufacturing in six European countries.

Technology as the driver

The accumulated data demonstrated that the concentration of market power behind the emergence of ‘superstar’ companies was characterized by an increasing intensity of competition in their given markets, allowing the most productive firms in each sector to gain share at the expense of less productive competitors.

There are several potential explanations for the emergence of ‘superstar’ firms. Network effects can partially explain the dominance of companies like Amazon and Facebook. Rapidly falling prices for information technology and intangible capital, such as software, can also give bigger players an advantage in many other sectors – just look at Walmart’s progress in supply chain logistics and stock control. Some economists have instead argued the emergence of the ‘superstars’ reflects weakening US antitrust enforcement, but the data and comparative experience in Europe suggest this is unlikely to be the primary explanation, though it may count in certain industries. The growth of concentration is disproportionately evident in those industries experiencing faster technological change – suggesting that technological developments, and not just anticompetitive forces, are an important factor behind the rise of the superstars.

The phenomenon explained

More productive firms have lower production costs and can thus sell their products at lower prices. This allows them to grow and obtain large market shares in their respective markets. These ‘Superstar’ companies are also able to impose higher price markups in their markets, which means that the sales price of their products is large relative to their production costs. Consider for instance a superstar retailer like Walmart in comparison to a small mom-and-pop store. Walmart has organized its internal logistics so efficiently that its internal costs per product are much lower than for the small store. Walmart can thus sell its products to consumers with a sizable price markup above its internal cost, and yet the resulting price will still be lower than the price of the small store which includes only a small markup above cost. As a consequence, ‘superstar’ companies are much more profitable than smaller competitors.

The high profitability of ‘superstar’ firms is a boon for these firms’ owners. In large companies, the income share going to capital is relatively large compared to income share of employees. This pattern does not necessarily imply that such firms pay their workers poorly. Indeed, large firms on average tend to pay equal or better salaries than smaller companies. However, large profits generate exceptionally high capital incomes.

The contribution of superstars to the falling labor share in the economy becomes clear when one contrasts the experience of such companies with smaller that of smaller firms. In most sectors of the US economy, the labor income share of an average firm has actually increased in recent decades. It is thus not the case that a force like automation has depressed workers’ incomes relative to capital incomes in most firms. Instead, ‘superstar’ firms have gained a greater weight in the overall economy, and the economy-wide labor share thus looks increasingly similar to the superstars’ lower labor share.

Consequences of higher market concentration and lower labor share

Labor income is more evenly distributed in society than is capital income. Most households obtain their income largely from labor, while they have neither much wealth nor capital income. That pattern is different for the households with the very highest incomes, who often obtain significant income from direct ownership of firms and from investment portfolios. The rise of ‘superstar’ firms and the resulting reduction in the labor share of income thus contributes to rising income inequality in society.

Beyond its distributional impacts, the dominance of ‘superstar’ firms also raises concerns in terms of competition policy. These firms have often gained their strong market positions thanks to superior innovation or efficiency compared to their peers. However, once they have achieved a commanding position, they may use their market power to erect barriers to entry to protect their positions.

Curiously, regulatory controls - which might on the face of it appear to be enacted to limit the scope of the ‘superstars’ – may in some situations prove advantageous to them. That is because such companies have reached a size and level of sophistication and expertise allowing them to navigate increasingly tricky regulatory waters that may waylay, and possibly deflect, smaller, weaker rivals. Moreover, while the costs of tackling regulation may be onerous, the relative burden for the superstars is smaller, as they are can defray such expenses over a much wider base of customers. Finding adequate competition policy response to the ‘superstar’ firm phenomenon is an area that warrants further research.

At its simplest, the total economic activity of a country can be attributed to two main factors of production: labor and capital. For much of the twentieth century, the relative contributions of labor income and capital to national value added were thought to be stable. This balance was considered a basic law of economics growth. John Maynard Keynes argued it was “something of a miracle” that the ratio of labor to capital income was constant.

The share of GDP attributable to labor is declining

Recent decades, however, have seen a drop in labor’s share of GDP, shifting the distribution of value added between labor and capital. Workers have tended to benefit ever less from the economic growth generated by their efforts. While the income share of labor in the US, for example, was more than 66% in 1980, it had fallen below 60% by 2010. In Germany, the drop was from 73% in 1980 to just over 66% by 2010 (Figure 1).

Further reading

Autor, David, David Dorn, Gordon H. Hanson, Gary Pisano and Pian Shu. 2020. ‘Foreign Competition and Domestic Innovation: Evidence from U.S. Patents.’, American Economic Review: Insights, 2, 357-374.

Barkai, Simcha. 2017. ‘Declining Labor and Capital Shares.’, Working Paper, University of Chicago.

Dao, Mai, Mitali Das, Zsoka Koczan, and Weicheng Lian. 2017. ‘Why is Labor Receiving a Smaller Share of Global Income? Theory and Empirical Evidence.’, IMF Working Paper.

Elsby, Mike, Bart Hobijn and Aysegul Sahin. 2013. ‘The Decline of the US Labor Share.’, Brookings Papers on Economic Activity, 1-42.

Karabarbounis, Loukas, and Brent Neiman. 2013. ‘The Global Decline of the Labor Share.’, Quarterly Journal of Economics, 129, 61-103.

Koh, Dongya, Raul Santaeulalia-Lopis and Yu Zheng. 2018. ‘Labor Share Decline and Intellectual Property Products Capital.’, Working Paper, Barcelona GSE.

Lashkari, Daniel, Arthur Bauer and Jocelyn Boussard. 2019. ‘Information Technology and Returns to Scale.’, Working Paper, Boston College.

Author

David Dorn is the UBS Foundation Professor of Globalization and Labor Markets at the University of Zurich and the director of the university-wide interdisciplinary research priority program “Equality of Opportunity.” He was previously a tenured associate professor at CEMFI in Madrid, a visiting professor at the University of California in Berkeley, and a visiting professor at Harvard University.Professor Dorn’s research spans the fields of labor economics, international trade, economic geography, macroeconomics, and political economy. He published influential studies on the impacts of globalization and technological innovation on labor markets and society. David Dorn is among the 100 most highly cited economists worldwide in the last decade. In 2023, he was awarded the Hermann Heinrich Gossen Prize for the most accomplished economist in German-speaking countries under the age of 45.

David Dorn is the UBS Foundation Professor of Globalization and Labor Markets at the University of Zurich and the director of the university-wide interdisciplinary research priority program “Equality of Opportunity.” He was previously a tenured associate professor at CEMFI in Madrid, a visiting professor at the University of California in Berkeley, and a visiting professor at Harvard University.Professor Dorn’s research spans the fields of labor economics, international trade, economic geography, macroeconomics, and political economy. He published influential studies on the impacts of globalization and technological innovation on labor markets and society. David Dorn is among the 100 most highly cited economists worldwide in the last decade. In 2023, he was awarded the Hermann Heinrich Gossen Prize for the most accomplished economist in German-speaking countries under the age of 45.