1

In a nutshell

In the current discussions about how best to tax the wealthy, one question keeps coming up: Should taxes target the fluctuating value of assets or only profits realized from sales? This policy brief highlights the need for tax policies to focus on realized capital gains rather than just the value of held assets, adapting to the various factors driving asset price changes. It also suggests to tax gains from net rather than gross transactions and to reform end-of-life provisions such as basis step-up at death, thereby eliminating distortions in portfolio choice and tackling tax avoidance strategies like “buy, borrow, die.”

In the current discussions about how best to tax the wealthy, one question keeps coming up: Should taxes target the fluctuating value of assets or only profits realized from sales? This policy brief highlights the need for tax policies to focus on realized capital gains rather than just the value of held assets, adapting to the various factors driving asset price changes. It also suggests to tax gains from net rather than gross transactions and to reform end-of-life provisions such as basis step-up at death, thereby eliminating distortions in portfolio choice and tackling tax avoidance strategies like “buy, borrow, die.”

Opportunities for action

1

Policymakers should focus on taxing realized transactions rather than just the value of held assets whenever asset price changes are driven by factors beyond cash flows. This approach better aligns with who benefits and loses from asset price fluctuations.

2

Existing capital gains taxes often target the gross gains from each individual asset sale. Instead, we argue that a better tax base is obtained by netting across transactions in a given year. This eliminates the “lock-in” effect in portfolio choice whereby taxpayers have an outsized incentive to keep holding appreciated assets.

3

Future tax reforms should also re-evaluate policies like the “stepped-up basis,” which allows resetting the value of an asset at death for tax purposes, as they enable tax avoidance strategies such as “buy, borrow, die.”

1

Policymakers should focus on taxing realized transactions rather than just the value of held assets whenever asset price changes are driven by factors beyond cash flows. This approach better aligns with who benefits and loses from asset price fluctuations.

2

Existing capital gains taxes often target the gross gains from each individual asset sale. Instead, we argue that a better tax base is obtained by netting across transactions in a given year. This eliminates the “lock-in” effect in portfolio choice whereby taxpayers have an outsized incentive to keep holding appreciated assets.

Conclusion

This policy brief explores how modern finance principles can inform optimal capital taxation, particularly in the context of fluctuating asset prices. Traditional approaches often focus on cash flows as the main factor influencing asset prices, but our research expands the view to include changes in discount rates, risk premia, and subjective beliefs. It is useful to juxtapose our results with the following naive intuition implicit in proposals for wealth taxes or taxes on unrealized capital gains: When the value of Jeff Bezos’ Amazon stocks doubles so should his tax liability. We show that this intuition is, in general, incorrect. Optimal taxes instead generally depend on (i) whether Bezos sells his Amazon shares and (ii) whether and by how much cash flows, here Amazon’s profits, increase. Our research emphasizes that tax systems focusing solely on asset holdings, without considering transactions, are generally suboptimal. Prioritizing realized transactions over fluctuating asset values leads to better targeted tax policies in the complexities of modern financial markets.

This UBS Center Policy Brief summarizes Putting the ‘Finance’ into ‘Public Finance’: A Theory of Capital Gains Taxation by Mark Aguiar (Princeton University), Benjamin Moll (London School of Economics), and Florian Scheuer (University of Zurich). NBER Working Paper (2024).

This policy brief explores how modern finance principles can inform optimal capital taxation, particularly in the context of fluctuating asset prices. Traditional approaches often focus on cash flows as the main factor influencing asset prices, but our research expands the view to include changes in discount rates, risk premia, and subjective beliefs. It is useful to juxtapose our results with the following naive intuition implicit in proposals for wealth taxes or taxes on unrealized capital gains: When the value of Jeff Bezos’ Amazon stocks doubles so should his tax liability. We show that this intuition is, in general, incorrect. Optimal taxes instead generally depend on (i) whether Bezos sells his Amazon shares and (ii) whether and by how much cash flows, here Amazon’s profits, increase. Our research emphasizes that tax systems focusing solely on asset holdings, without considering transactions, are generally suboptimal. Prioritizing realized transactions over fluctuating asset values leads to better targeted tax policies in the complexities of modern financial markets.

This UBS Center Policy Brief summarizes Putting the ‘Finance’ into ‘Public Finance’: A Theory of Capital Gains Taxation by Mark Aguiar (Princeton University), Benjamin Moll (London School of Economics), and Florian Scheuer (University of Zurich). NBER Working Paper (2024).

Callouts

Further reading

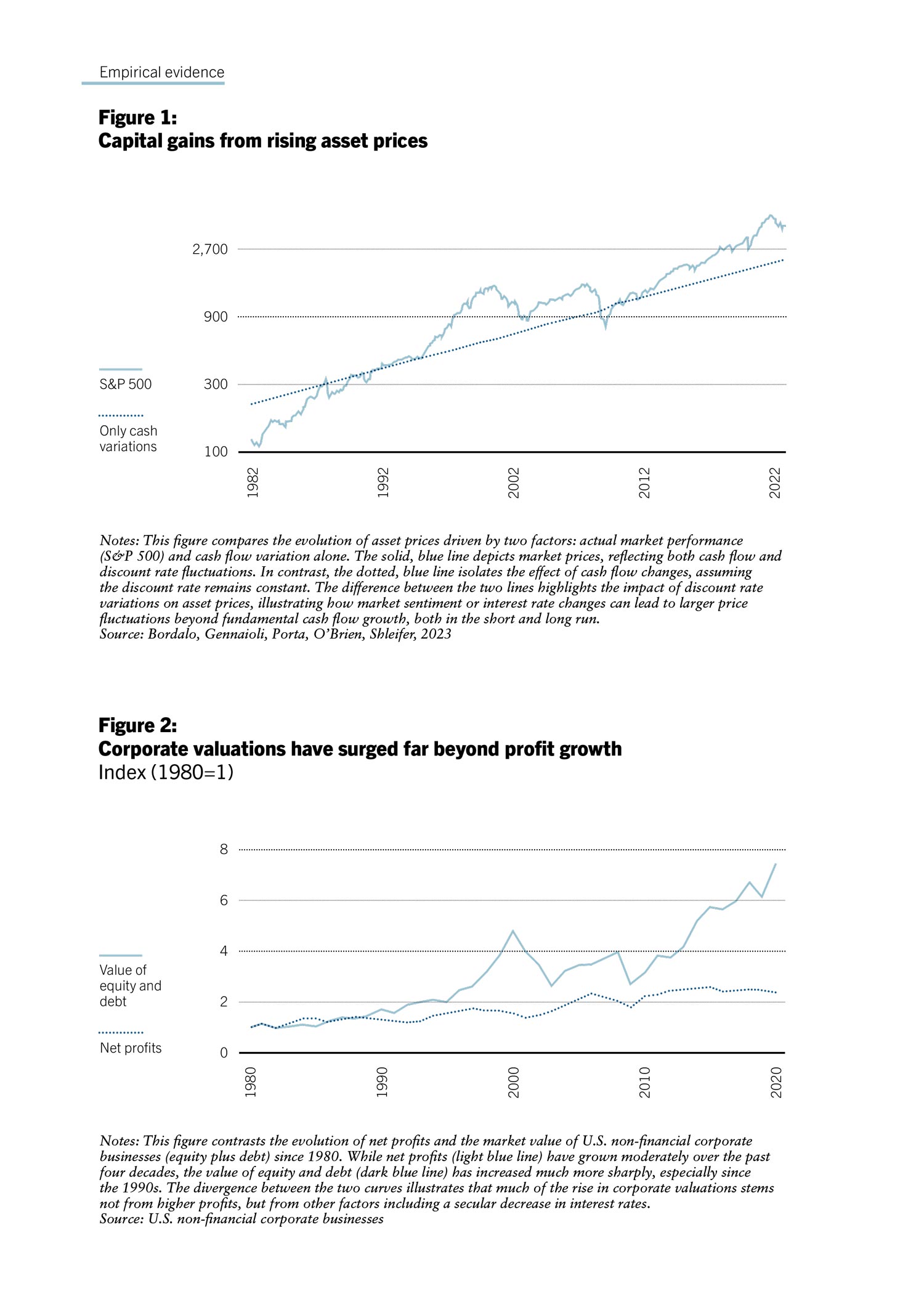

Bordalo, Pedro, Nicola Gennaioli, Rafael La Porta, Matthew OBrien, and Andrei Shleifer, Long-Term Expectations and Aggregate Fluctuations, NBER Macroeconomics Annual, 2023, 38.

Campbell, John, and Robert Shiller, The dividend-price ratio and expectations of future dividends and discount factors, The Review of Financial Studies, 1988, 1 (3), 195–228.

Fox, Edward, and Zachary Liscow, No More Tax-Free Lunch for Billionaires: Closing the Borrowing Loophole, Tax Notes Federal, 2024.

Leiserson, Greg, and Danny Yagan, What Is the Average Federal Individual Income Tax Rate on the Wealthiest Americans?, U.S. Council of Economic Advisors, Washington, DC, White House, 2021.

Saez, Emmanuel, Danny Yagan, and Gabriel Zucman, Capital Gains Withholding, UC Berkeley working paper, 2021.

The Economist, Sweet gains, bro, June 22, 2024, Issue, Finance and Economics Section, 2024.

U.S. Department of the Treasury, General Explanations of the Administration’s Fiscal Year 2023 Revenue Proposals, Department of the Treasury, March 2022.

U.S. Office of Management and Budget, Budget of the U.S. Government, Fiscal Year 2023, U.S. Government Publishing Office, 2022.

Zucman, Gabriel, A blueprint for a coordinated minimum eff ective taxation standard for ultrahigh-net-worth individuals, Technical Report, 2024.

Author

Florian Scheuer received his PhD from MIT in 2010. He is interested in the policy implications of rising inequality, with a focus on tax policy. In particular, he has worked on incorporating important features of real-world labor markets into the design of optimal income and wealth taxes. These include economies with rent-seeking, superstar effects or an important entrepreneurial sector, frictional financial markets, as well as political constraints on tax policy and the resulting inequality. His work has been published in the American Economic Review, the Journal of Political Economy, the Quarterly Journal of Economics and the Review of Economic Studies, among other journals. In 2017, he received an ERC starting grant for his research on “Inequality - Public Policy and Political Economy.” Before joining Zurich, he was on the faculty at Stanford, held visiting positions at Harvard and UC Berkeley and was a National Fellow at the Hoover Institution. He is Co-Editor of Theoretical Economics and Member of the Board of Editors of the Review of Economic Studies. He is also a Co-Director of the working group on Macro Public Finance at the NBER. He has commented on tax policy in various US and Swiss media outlets.

Florian Scheuer received his PhD from MIT in 2010. He is interested in the policy implications of rising inequality, with a focus on tax policy. In particular, he has worked on incorporating important features of real-world labor markets into the design of optimal income and wealth taxes. These include economies with rent-seeking, superstar effects or an important entrepreneurial sector, frictional financial markets, as well as political constraints on tax policy and the resulting inequality. His work has been published in the American Economic Review, the Journal of Political Economy, the Quarterly Journal of Economics and the Review of Economic Studies, among other journals. In 2017, he received an ERC starting grant for his research on “Inequality - Public Policy and Political Economy.” Before joining Zurich, he was on the faculty at Stanford, held visiting positions at Harvard and UC Berkeley and was a National Fellow at the Hoover Institution. He is Co-Editor of Theoretical Economics and Member of the Board of Editors of the Review of Economic Studies. He is also a Co-Director of the working group on Macro Public Finance at the NBER. He has commented on tax policy in various US and Swiss media outlets.