8

Publications

Public Paper Series

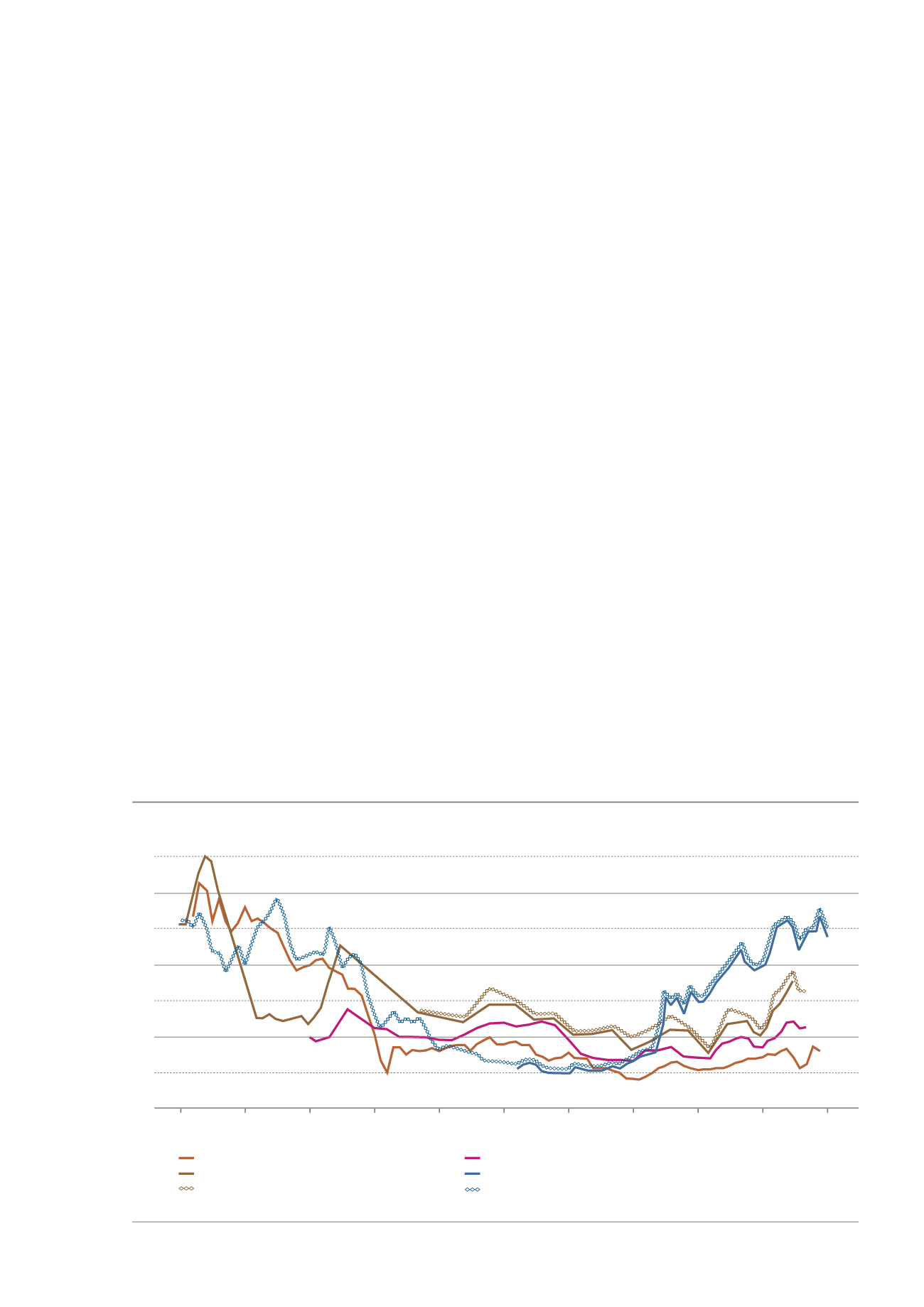

paper shows that the income distribution in Switzer-

land is surprisingly stable, and the opening of the

“income scissors” is thus more perceived than real.

The Gini coefficient, as a measure for total unequal

income distribution, has only changed negligibly, and

the share of the wealthiest 1% (and thus of the famed

remaining 99%) on aggregate income has remained

relatively stable over the last decades (see graph). The

super rich remain the only exception, as their share

has increased strongly in recent years.

Swiss stability is even more evident in the distribution

of wealth, where the absence of wars and crises and

the existence of predictable economic policies has

given Switzerland a highly stable distribution of

wealth, which is internationally a special case. A

result of this unusual stability is that the concentra-

tion of wealth in Switzerland is among the highest

worldwide. The authors show, however, with new

research results that this measure becomes more

relative when pension fund assets, which are very

important in Switzerland, are included.

The stability here definitely becomes a problem in the

area of mobility. Economists consider this to be

The distribution of

income and wealth in

Switzerland

The new UBS Center Public Paper shows that Switzer-

land is a center of stability – in a good as well as in a

less good sense.

Although Switzerland regularly takes on the best posi-

tions in the world with respect to average income and

wealth, the question of distribution consistently

defines public discourse in the country. Political

processes, which constantly fight perceived, continu-

ally increasing inequality, are not lacking. In the past

years, Swiss citizens voted on a national inheritance

tax, the 1:12 plebiscite, or the “Abzocker” plebiscite

against high executive compensation, and the Swiss

young socialists launched the so-called “99% plebi-

scite” in October 2017.

Although an actual increase in inequality can actually

be observed in many countries, the new UBS Center

France

(without capital gains)

Germany

(without capital gains)

Germany

(incl. capital gains)

Switzerland

(without capital gains)

USA

(without capital gains)

USA

(incl. capital gains)

1913 1923 1933 1943 1953 1963 1973 1983 1993 2003 2013

Source: WID (World Wealth and Income Database).

Share of aggregate income in %

20

15

10

5

Share of the 1% with the highest income in an international comparison, 1913–2013